Published with permission from RISMedia.

Uncategorized

4 Steps to Design a Luxury Wine Room

Published with permission from RISMedia.

ATX Market Update

Earlier this year, the Austin MLS reached the highest number of active listings in history. Even with mortgage rates above 6.5 percent, it has been a buyer’s market.

In July 2025, Austin home prices increased by 2.3% compared to the same month the previous year, selling for a median price of $555,000. On average, homes in Austin sell after 61 days on the market compared to 55 days last year. There were 776 homes sold in July this year, down from 806 last year.

While the Federal Reserve’s short-term rates may decline, overall long-term rates are likely to remain elevated compared to pandemic-era lows. 30-year mortgage rates are projected to remain above 6% through 2025 and into 2026.

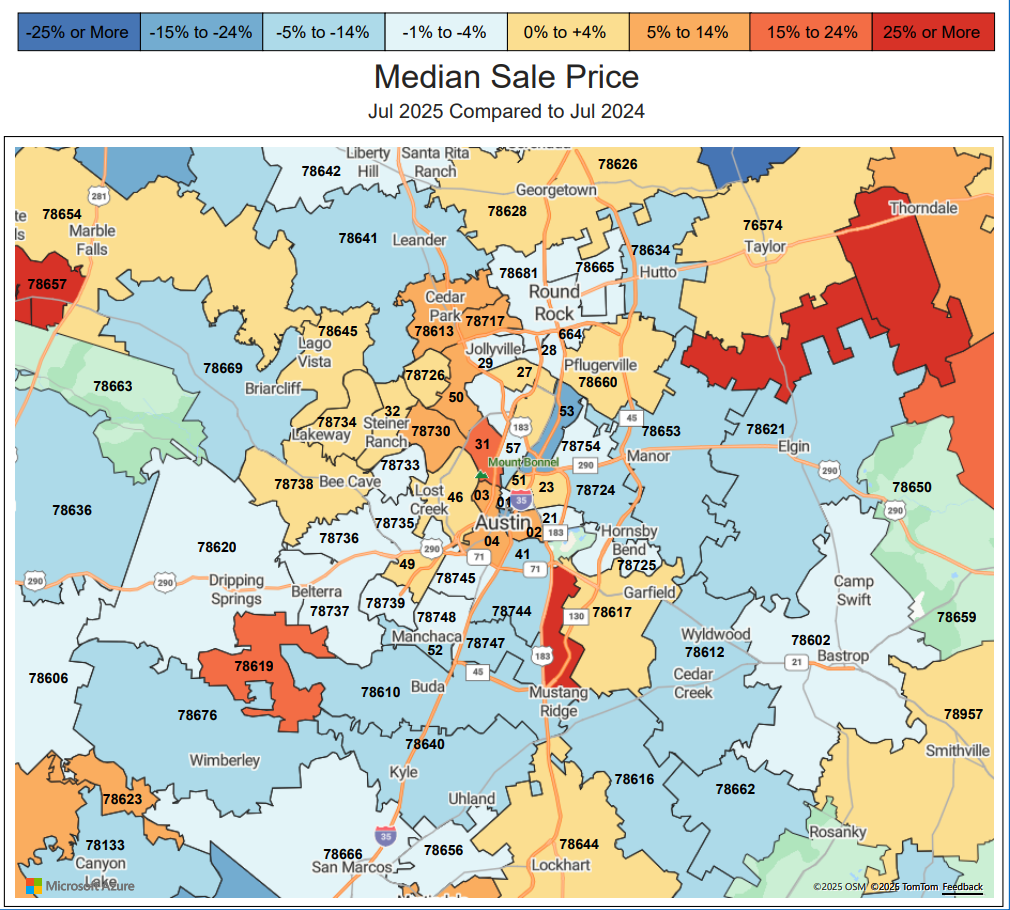

| Potential sellers should be prepared; any decrease in mortgage rates could enhance the appeal of their properties and improve buyers’ loan qualifications. The map above illustrates year-over-year median prices, which are finally showing more yellow and orange than any of the previous maps we have shared this year. As of late August 2025, rates have leveled off, with some sources noting they are at their lowest in about 10 months. This is excellent news for buyers and sellers! If you have friends or family considering a move to Austin, we would be delighted to assist them personally. – Mary Lynne Gibbs, 512-431-2403. |

Beat the Heat in Style With These Swimming Pool Designs

When temperatures soar, theres no better way to cool off than taking a dip in the pool. For many high-end homebuyers, a swimming pool is an essential feature that theyre not willing to live without. If youre thinking of adding one to your property, there are tons of different design details to take into consideration. One thats always in-demand is the infinity edge pool, but going beyond that, there are plenty of other exciting features.

Here are just a few fun ideas to design the perfect swimming area for your home:

Walk-In Entry

Also known as a beach entry or zero entry, walk-in swimming pools have a gradual slope so you can ease into the water just like youre at the beach. Ideal for kids who like to splash around or grandparents who might have difficulty on steps, walk-in pools can also include built-in lounge chairs for the perfect spot to soak up rays while staying cool.

Swim-Up Bar

If youre an avid entertainer, a swim-up bar might be in store. All it really takes is a couple of bar stools built into the pool with a raised counter along the edge, but it works best if you can incorporate a sunken barbecue area or outdoor kitchen on the other side of the counter. That way, youll have yourself the ultimate backyard paradise.

Waterfall Feature

Whether its a nature-inspired waterfall or an artistic fountain, having a feature of this sort provides a true spa-like experience. In addition to the dramatic visual appeal, the relaxing sound of cascading water makes your swimming pool a veritable private oasis.

Inset Hot Tub

If youre going to have a swimming pool, why not include a hot tub? Inset hot tubs make for a seamless transition between the two, making it appear as if theyre practically connected. You can easily move between hot and cold with a stunning design that leaves nothing to be desired.

Lights and Music

You and the kids could have fun in the pool at all hours by adding colorful lights and underwater music. Or, if you need a spot to unwind, you can use calming colors and tranquil tunes for a relaxing multi-sensory experience while youre floating.

Published with permission from RISMedia.

6 Steps to a Buzz-Worthy Backyard

Published with permission from RISMedia.