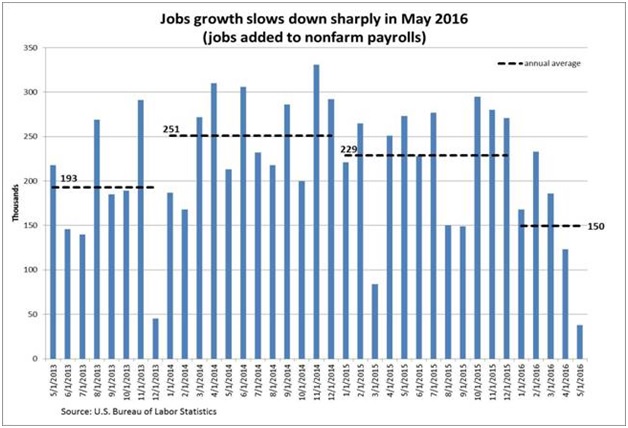

The Bureau of Labor Statistics released its most recent job report showing that the U.S. economy added only 38,000 jobs in May, far below expectations. That’s much lower than the 150,000 new jobs the economy was expecting. A low jobs report number is a sign of a sluggish economy. The headline number was reduced by 35,100 due to striking workers at Verizon Communications. Without the strike, payrolls would have increased by 73,000. Either way, the jobs growth in May was much slower than it was earlier in the year.

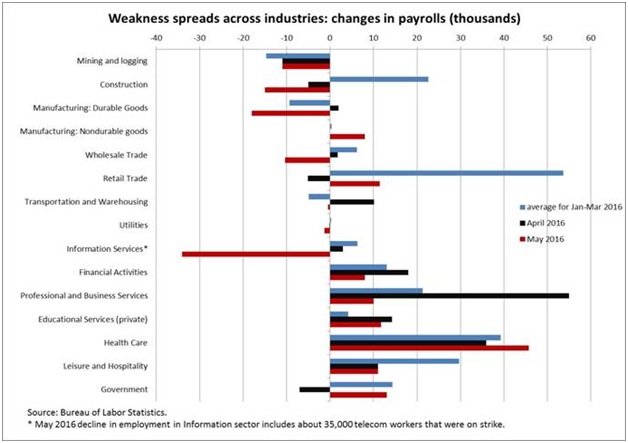

Construction lost 15,000 jobs. That signals a slowdown in the housing market. U.S. manufacturing lost 10,000 jobs due to a strong dollar that hurt exports. Durable goods lost 18,000 jobs, with 500 from auto manufacturing. Pay close attention to how many manufacturing jobs are added or lost each month, since it is a future indicator of economic health. That’s because factories are less likely to add workers until they have orders for more goods in hand. Manufacturing employment provides a better leading indicator of future economic performance than does service employment, which stays more consistent through thick and thin.

The US hasn’t seen such low positive jobs gains since December 2010 — or, in other words, since the aftermath of the Great Recession.

What effect does this have?

- The US dollar is getting slammed in world currency markets. When there is not confidence in the American labor market, the dollar loses value against other currencies. If the American dollar loses value, you lose buying power. As most of us know wages have not kept up with inflation.

- With less confidence in the strength of the labor market, stock values drop historically.

- Consumers are running for the safety of US Treasuries.

Another worrying sign is that the weakness in job creation appears to be spreading across industries.

Earlier this year, only mining and logging, durable goods manufacturing, and transportation were posting job losses. This was easily explained by shrinking domestic oil production as a result of a sharp decline in crude oil prices. Employment in oil extraction (part of the mining and logging sector) was shrinking, as was production of heavy equipment used in the oil sector, leading to job losses in durable goods manufacturing. Transportation of domestic crude oil (much of which is done by rail) was falling as well. There was a possibility that the weakness and the job losses would be contained in the industries affected by crude oil production.

But in April and May, it seems that the job losses spread to other industries. Now, in addition to mining, durable goods manufacturing and transportation, job losses have appeared in construction, wholesale trade, utilities, retail sales, and information services (although the last one is mostly due to a strike). Other industries continue to add jobs, but at a much slower pace than before. This is a worrying sign.

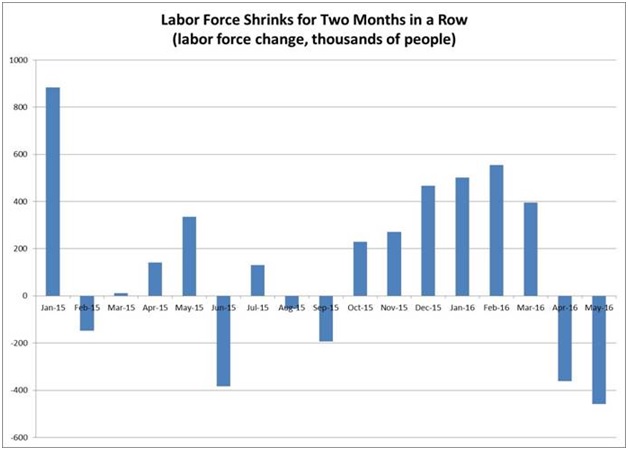

And yet, the unemployment rate still fell in May to 4.7 percent, from 5 percent in April. How can this be? The answer is not encouraging – the drop in the unemployment rate is mostly driven by people dropping out of the labor force. In May, 458,000 people left the labor force, after 362,000 did so in April. Such a substantial decrease in the labor force for two months is a row is unusual (see below) and is yet another worrying sign.

This was a very disappointing employment report with several worrying signs for the economy long term. It makes it nearly certain that the Federal Reserve will not raise interest rates when it meets in June. We will be watching other data carefully to see if the worrying signs seen here are confirmed by other information.

Local impacts

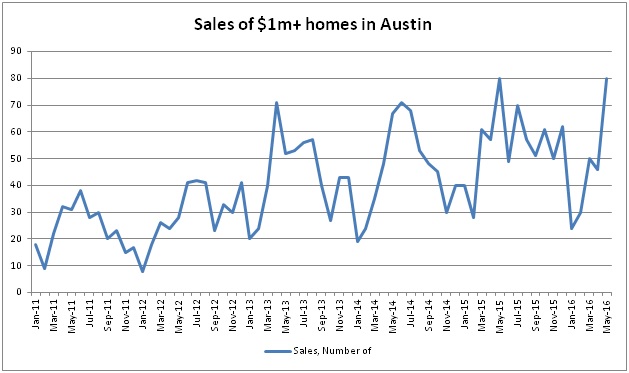

Austin and the other Texas metros continue to be sellers’ markets, with not enough commercial or residential inventory. However there are concerns in certain portions of the residential market, namely in luxury sales in Austin above $1 million.

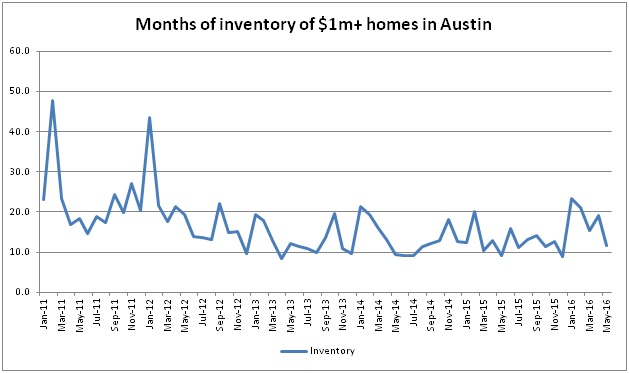

The charts below show Austin luxury sales are still robust compared to the recession, but slower than 2013 or the highs of 2015.

So what happened? Take a look at the Austin $1+ million inventory report below. It clearly shows that in 2016, luxury above a million sales slowed and the amount of inventory picked up. Inventory doubled since 2015 to 20 months, reflecting a buyers’ market.

Consumer confidence in the Texas region has dropped 35 points in the last year. Consumers are not feeling as flush as they have previously. Luxury is showing it first. Historically the top portion of the market begins to show a slowing of the market first. It is not just a regional thing, we are seeing national GDP and inflation slow dramatically this last quarter. Declines in oil, rumors of another tech bubble, and confusing election hyperbole are causing many to be much more conservative in their selection process.

What would I tell your clients that are buying or selling in the over $1 million price category? It is still a good market if your listing is priced correctly. Those homes that are within 95 to 100% of the median price per square feet are still selling quickly. Be aware of what is in the neighborhood and what is in that price range. Not all houses are created equal. Values cannot be based just on square footage. Sellers will have difficulty moving their properties if they ‘ego price’.

On the demand side of the equation, some have asked if there are fewer companies and executives moving to Austin or other Texas metros. Those at the Chamber of Commerce are still seeing quality companies and executives moving here. However many in the equity business feel that technology is overvalued like 1999, and that there should be a correction. Therefore executives are much more conservative in spending, because of what they are hearing from markets. Trophy properties are taking almost three times as long to sell in Austin as what the rest of the market is doing. As an analyst, I will tell you if priced correctly it should still sell.

Otherwise it is very much a sellers’ market. Austin is still creating jobs, the rental market continues to be tight, and most homes if properly priced have multiple offers. Real estate appreciation is apparent in all markets, channels, and Texas metros. At most price points there is not enough rentals or homes for sale. Foreclosures and short sells are a non-factor at less than 1% of the market. The Texas real estate market is still strong in all channels, but there is some softening in luxury homes. So yes, the market is changing, and yes we should continue to watch.