Click on any image above to view infographics for each area.

Austin Board of REALTORS® releases June 2016 & Mid-Year 2016 Central Texas Housing Market Report

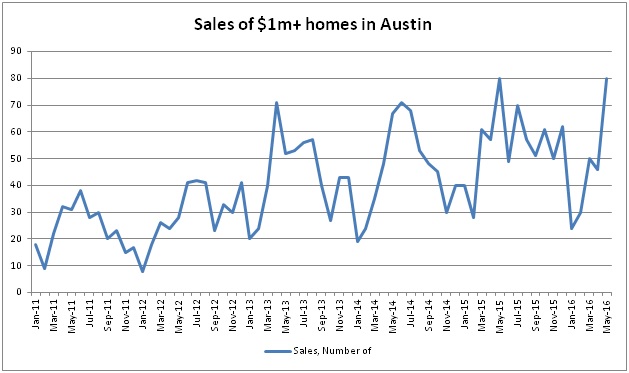

AUSTIN, Texas – July 15, 2016 – Single-family home sales and prices experienced strong gains throughout the Central Texas region in the first half of 2016, according to the June & Mid-Year 2016 Central Texas Housing Market Report released today by the Austin Board of REALTORS®.

“Despite the ongoing housing shortage and affordability challenges impacting our region, population growth and housing demand continue to drive home sales upward,” said Aaron Farmer, 2016 President of the Austin Board of REALTORS®. “The Austin-Round Rock housing market is on track to outpace 2015 market levels, which was a record-breaking year for home sales.”

Austin-Round Rock Metropolitan Statistical Area (MSA)

Single-family home sales in the five-county Austin-Round Rock MSA rose 6.1 percent year-over-year to 14,482 home sales in the first half of 2016, while median price rose seven percent year-over-year to $282,000. Home listings also experienced gains in the first half of the year, with active listings increasing 6.6 percent to 5,290 listings, new listings rising 5.7 percent to 20,060 listings, and pending sales rising 7.2 percent to 15,909 sales.

Rising home sales and home prices means a greater impact on the region’s economy as well. Sales dollar volume in the Austin-Round Rock area was $5,073,874,678, an 11.5 percent increase from the first six months of 2015.

Single-family housing market activity continued to be strong in June 2016, with home sales jumping to 3,219 sales, an 8.5 percent increase compared to June 2015. Median price rose 8.2 percent to $295,500 during the same time frame. Monthly housing inventory remained unchanged at 2.5 months, which is less than half of the Real Estate Center at Texas A&M University’s benchmark of 6.5 months as a balanced housing market.

City of Austin

Despite ongoing housing affordability challenges, single-family home sales in the City of Austin increased 3.4 percent to 4,465 home sales in the first half of 2016. Of the 21,036 single-family homes sold in the 18-county Central Texas region in the first half of 2016, approximately only one in five (21 percent) were sold within the Austin city limits. Median price increased 5.6 percent to $339,652 in the first half of the year, while active listings jumped 20.1 percent to 1,298 listings during the same time frame.

In June 2016, Austin home sales increased 2.6 percent to 975 home sales, while median price increased only 2.9 percent to $350,000. Monthly housing inventory increased 0.3 months to 2.1 months, while homes spent a little more than one month (32 days) on the market on average, an increase of two days from June 2015.

“The Central Texas housing market is performing very well, but extreme housing shortages across the region continue to be a challenge,” said Jim Gaines, Chief Economist at the Real Estate Center at Texas A&M University. “Homes under $300,000 have less than two months of inventory in the Austin-Round Rock MSA, which means that housing at these price ranges is essentially nonexistent. The growing “donut effect” of homes sales activity as homebuyers move outside Austin city limits in search of more affordable housing is on pace to continue in the near future.”

Travis County

In the first half of 2016, Travis County single-family home sales increased 4.9 percent year-over-year to 7,203 home sales–nearly half of all single-family homes sold in the five-county MSA during the same time frame. In the meantime, median price increased 7.8 percent year-over-year to $330,000. In June 2016, single-family home sales increased 5.2 percent to 1,567 home sales, median price rose 10 percent to $357,500. However, monthly housing inventory stayed steady at 2.6 months.

Williamson County

Williamson County single-family home sales jumped 11.9 percent year-over-year to 1,140 home sales in June 2016, while median price rose 8.7 percent to $269,500 during the same time frame. Housing inventory dropped 0.2 months to 2.1 months of inventory in June 2016, making the housing shortage in Williamson County equally as critical as in the City of Austin.

In the first half of 2016, single-family home sales jumped 7.2 percent to 4,966 home sales, while median price rose 6.3 percent to $260,000. More homes were sold in Williamson County in the first half of the year than in the City of Austin (4,465 home sales year to date), despite having a population half the size of the City of Austin’s.

Hays County

In the first half of 2016, Hays County single-family home sales rose 5.1 percent year-over-year to 1,677 home sales, while median price increased 4.7 percent year-over-year to $243,000. As a result of strong housing development and sales activity throughout the county, new listings increased 12.2 percent year-over-year to 2,332 listings and active listings jumped 17.3 percent year-over-year to 732 listings in the first half of the year. In June 2016, single-family home sales increased 5.8 percent year-over-year to 366 home sales, while median price crept up 2.3 percent to $249,950 during the same time frame.

“It’s important that we think of the growing housing affordability crisis not just as an Austin issue, but also as a regional challenge,” concluded Farmer. “Housing supply shortages have reached critical levels throughout the region and areas with affordably priced homes are becoming smaller and father away from jobs. Some homebuyers are now looking at homes an hour or more outside of Austin to find a home that they can afford. City of Austin leaders as well of those of surrounding cities must come together to solve our region’s challenges in housing supply, affordability and infrastructure.”